Hong Kong’s oyster sauce king buys London’s ‘Walkie Talkie’ tower for record £1.3 billion

Lee Kum Kee, the inventor of the oyster sauce and producer of more than 200 types of condiments, is the latest among Hong Kong’s companies to be piling into overseas property, amid record prices at home.

PUBLISHED : Thursday, 27 July, 2017

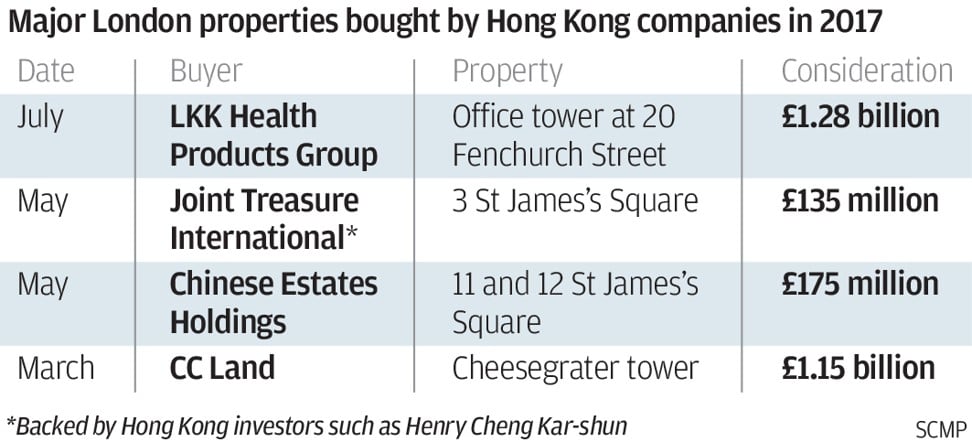

Lee’s property investment arm Infinitus will buy 20 Fenchurch Street, a London office tower affectionately known as the “Walkie Talkie” building because of its distinctive top-heavy shape, from Land Securities Group and the Canary Whart Group, according to a press statement by LKK Health Products’ chairman Sammy Lee.

The oyster sauce is Lee’s best-known product, helping to propel the group’s growth into one of Hong Kong’s best known brands, and helping it to diversify into health products, property investments, plantations and trading.

Completed in 2014, the 37-storey “Walkie Talkie” tower is the sixth-tallest in London, with 1.4 million square feet (130,000 square metres) of office, retail and commercial space. With a 360-degree view across central London, the tower designed by Rafael Viñoly Architects features the famous Sky Garden, one of the city’s most popular tourist attractions.

There just aren’t that many premium Grade A office buildings anywhere in Hong Kong that can be acquired for less than HK$20 billion (US$2.6 billion), said Thomas Lam, Head of Valuation & Consultancy at Knight Frank.

“The weaker pound, which has fallen about 20 per cent from the peak, now makes London property more affordable,” Lam said.

Billionaire Chen Hongtian’s Cheung Kei Group last week completed a £410 million acquisition of a 12-storey office building at Canary Wharf, the biggest real estate sale in the financial district since 2014. Chen will rename the building the Cheung Kei tower.

In March, Chongqing-based tycoon Cheung Chung-kiu’s CC Land Holdings paid £1.135 billion to buy the Leadenhall Building in London, better known as the “Cheesegrater.”

Attractive rental yield is another major attraction of UK property, said JLL’s research head Denis Ma. Combine that with low borrowing costs and a weak pound, there are plenty of reasons to attract Hong Kong investors to flock to the UK’s commercial property market, he said.

“The yield on a prime office building London is typically 3.5 per cent, compared with just 2.9 per cent in Hong Kong,” Ma said. “While local investors are looking to exit the UK market because of softening rents, Hong Kong investors remain upbeat on the market.”

No comments:

Post a Comment

Comments always welcome!